Machine Learning Applications in Banking

Machine learning algorithms are most effective in banking for identifying patterns. Using the vast databases that banks amass, machine learning can be applied in the banking industry to produce insights that can be put into practice.

Machine learning models can assist banks in processing and analyzing such data to gain a better understanding of their customers and internal procedures, whether it be a transactions history, conversation logs with bank staff, or corporate documents.

Banking sector has tapped into the vast power of ML to provide banking solutions for both the front and back ends processes to increase productivity and enhance customer experience.

Banking can gain from machine learning since it facilitates the adoption of excellent management inside an industry, improves customer experience, and simplifies installation and various operations — now let us make a fair analysis by outlining the applications.

Applications of ML in banking

1. Fraud Detection

Traditionally, rely on pattern matching with known types of fraud from the past. Then, based on general guidelines, transactions are evaluated. Also, trend-spotting by people who manually upgrade models to take into consideration changes in potential fraud.

With machine learning, for each consumer, past transaction data is analyzed by algorithms to determine their unique spending habits. As a result, they can detect minute irregularities that point to fraud. Large volumes of data can be processed quickly using machine learning algorithms.

Additionally, the capacity to build on prior knowledge and enhance models reduces the need for human input. ML-based algorithms can keep one step ahead of fraudsters because they self-learn, which allows them to rapidly adapt to new fraud methods.

Most fraud happens when consumers pay for goods, whether online or off. This is avoided in banking via machine learning in a number of ways. Face recognition, for instance, can be used to verify that the individual using the credit card actually owns it.

2. Risk Management

One of the most practical applications of machine learning in banking is risk management. Machine learning has the potential to drastically speed up and reduce risk in the approval of loans for banks.

Applications for credit scoring use information from rent payments, social media accounts, telecommunications providers, bank histories, and tax payments to quickly and completely assess a loan applicant. Machine learning algorithms create a credit score to signify risk by comparing other customers’ data.

Through precise reporting, ML algorithms lower risks for clients as well as banks. After granting customers credit, machine learning can make predictions based on past transactions. Employees are more knowledgeable about credit risk assessment. The banking sector can become ready in advance thanks to the early detection of faults and the provision of possible future dangers.

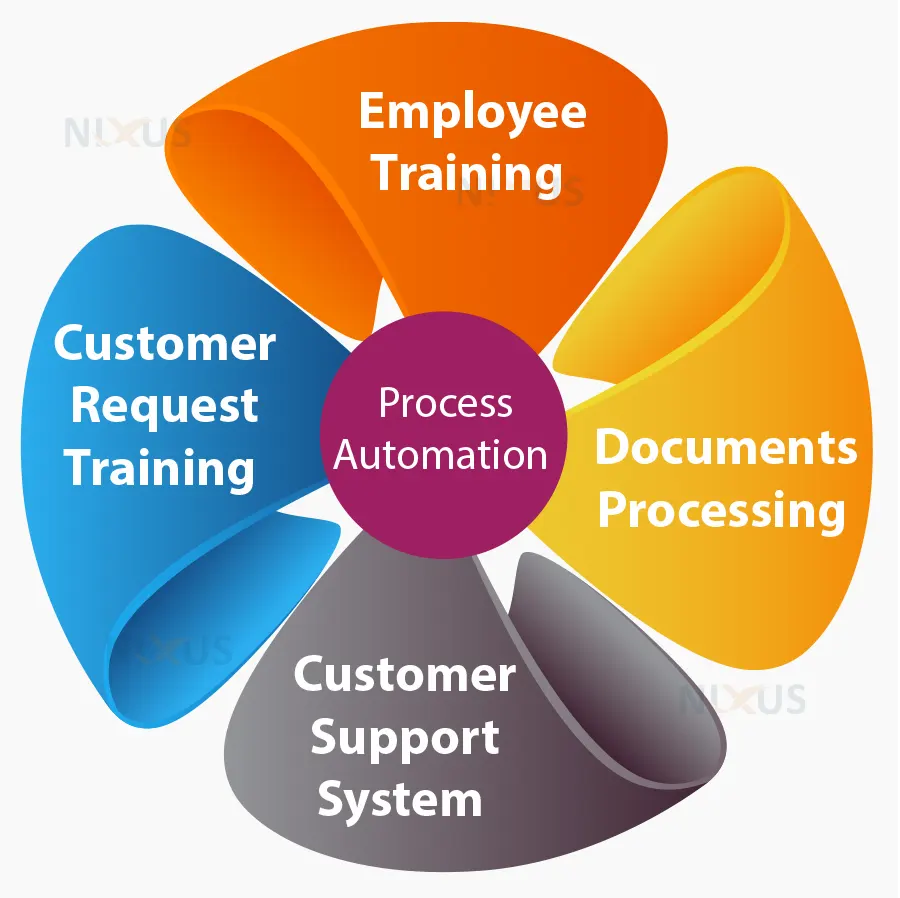

3. Process Automation

Banking sector can entirely replace time-taking manual work and create additional value in the process by automating repetitive operations like employee training, documents-related processing, customer request tracking, and other areas using robotic automation.

Machine learning is capable of handling routine activities with ease, giving managers additional time to focus on complex problems rather than tedious paperwork. Increased revenues will ultimately result from automation of processes across the industry.

Additionally, machine learning makes it simple to use the data, evaluate behavior, and identify patterns. This might be utilized right away for customer help desk systems that can function similarly to a real person and respond to each and every one of the customers’ specific problems.

4. Enhanced Decision-Making

Enhanced decision-making is one of the applications of machine learning in banking. Machine learning techniques can be used by banking institutions to examine both the structured as well as unstructured data.

The primary ability of ML to do this is to offer a neutral, unbiased evaluation. The vast amount of information gathered from the prospective borrower helps banks make wiser decisions.

Processing data manually would merely scrape the top surface of the insights that lay within the available amount of structurally different data that the banking system readily produces every day.

Machine learning use examples in banking show how incorporating the technology to sift through massive amounts of data may yield insightful information that enhances business decision-making, and highlights lucrative prospects.

5. Payments in banking

The application of machine learning to payment procedures has positive effects on the payments sector as well. By lowering transaction costs, the technology enables payment companies to expand their customer base. The ability to optimize payment routing depending on performance, functionality, pricing, and many other factors is one of the benefits of machine learning in payments.

Machine learning systems can efficiently distribute traffic to the optimal combination of factors by processing a variety of data sources. Using this capability, banking institutions can provide merchants with the greatest outcomes based on their unique goals.

Additionally, a number of machine learning applications that are linked to a payment system can analyze accounts and enable users to keep and expand their money. To evaluate user activity and create tailored offers, sophisticated Machine learning algorithms can be deployed.

6. Enhanced User Experience

When banks have the chance to fully understand a user’s activity over a network, they also have the chance to enhance the customer experience in every way possible.

Since technology is transforming practically every aspect of everyday life, customers are ready to receive improved services from financial institutions.

Banks that could offer greater security and a customized experience will also draw in more customers. Customers usually want user-friendly digital banking solutions. Reducing the amount of time required for banking processes and credit decisions is one way that is being used by machine learning to enhance the customer’s overall experience.

Previously taking weeks, loan applications can now be submitted in a matter of days. Machine learning is capable of doing an honest analysis based on various credit indicators.

7. Personalization

The adoption of excellent management within an organization, increased customer happiness, and the provision of more individualized and straightforward operations and assistance are all advantages that banks can gain from machine learning.

Banking institutions can learn what users demand right now and, in addition, what they are able and willing to pay for by having a wide range of data about customer activity.

Success in banking is aided by personalization. It depends on a thorough comprehension of client demands and the careful structuring of offers to meet those needs.

Banks are currently enhancing customization for some goods using machine learning. It may make sense to create a tailored loan offer, for example, if a customer was browsing automobile dealer advertisements. Of course, this would only be done after assessing the client’s solvency and any associated risks.

8. Credit Scoring in Banking

The most potential application of machine learning in banking is arguably credit scoring. It assesses a customer’s ability to pay and how likely they are to make plans to repay their debts. Credit scoring services are desperately needed since there are plenty of unbanked population in the globe out of which about half of the population qualifies for credit.

In order to uncover hidden characteristics about customers, machine learning in credit scoring can sift through large sets of data, transaction specifics, and behavior patterns. Consequently, machine learning algorithms can produce highly customized offers that increase revenue by serving more users, including those who are regarded as being credit invisible.

Decisions made by machine learning scoring algorithms are based on a variety of information, such as transaction assessment, credit history, and overall income. It is a mathematical model built on principles of accounting and statistics.

Therefore, ML-based algorithms can produce more sensitive, personalized, and accurate credit score analysis and enable more people to access credit.

Machine learning algorithms can assess borrowers objectively, in contrast to human scorers. Furthermore, businesses can eliminate racial, gender, and other biases with the aid of machine learning in banking and provide services to a wider audience more equally by eliminating these biases.

Therefore, it is valid to say that machine learning in credit scoring offers a wide range of advantages, with users being able to apply for loans online in just a few clicks without having to leave their homes.

Conclusion

Machine learning in the banking sector can boost these businesses’ profits and user confidence. Banking applications for machine learning put pressure on rival businesses to create quicker, more affordable, and superior products.

To be competitive, banking institutions must offer customers highly individualized, prompt, and reasonably priced goods and services. Machine learning can be used to successfully complete tasks like security and fraud detection, risk assessment, and enhanced customer experience, among others.