Machine Learning for Risk Management

Risk assessment is another area where machine learning, a burgeoning academic topic, has demonstrated its supremacy. Activities including identifying, planning, evaluating, and controlling situations that endanger project progress are all included in risk management and assessment.

The discipline of data prediction and risk management has benefited greatly from machine learning technology’s continued advancement and maturity.

The potential of machine learning to drastically change a business’s daily operations is becoming more widely acknowledged across industries. /ML has come to represent cost-effectively increasing productivity and performance in risk management. This has been made feasible by the capability of technology to process and analyze huge amounts of unstructured data more quickly and with a lot less human involvement. Along with improving credit decision-making accuracy, technology has also allowed banks and other financial institutions to reduce regulatory, operational, and compliance expenses.

As a result, financial institutions are now able to develop expertise around consumer intelligence, enable the successful application of initiatives, and reduce possible losses thanks to ML technologies’ capacity to generate vast amounts of timely, correct data.

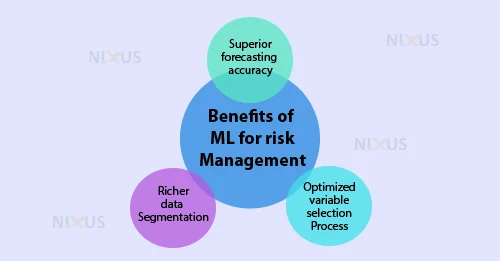

Benefits of ML-based risk management solutions

As mandated by global prudential authorities, ML-powered solutions for risk management can also be utilized for risk management models and stress testing, and they might offer the following main advantages:

1. Particularly in the case of a strained scenario, typical regression models fall short in capturing the non-linear correlations between a company’s financials and the macroeconomy. Due to the capability of models to identify nonlinear effects among risk factors and scenario features, machine learning enables enhanced predicting accuracy.

2. Processes for extracting features and variables from risk models used internally for decision-making consume a large amount of time. Big Data analytics platforms combined with ML algorithms can process enormous amounts of data and extract several features. Strong, data-based risk models for stress testing can be produced by combining a wide range of risk factors with a rich feature set.

3. To handle a changing portfolio formation, appropriate segmentation and granularity are essential. Superior segmentation is made possible by ML algorithms, which also take various segment data attributes into account. Using both density and distance-based techniques for clustering becomes a possibility when employing unsupervised ML algorithms, resulting in greater explanatory power and accuracy of the model.

Applications of Machine Learning in Risk Management

1. Fraud Detection

Credit card transactions provide banks with a wide range of data to analyze and train algorithms (unsupervised learning) on; therefore, banks have been utilizing machine learning approaches for credit card portfolios for long. Because models can be developed, trained, and validated on vast amounts of data, they have historically been very accurate in detecting fraud.

The identification of credit card fraud is one area where machine learning has been used for over a decade with notable results. Banks have installed monitoring systems, or “workflow engines,” in their credit card payment infrastructures to keep an eye out for suspected fraud.

Workflow engines are built into credit card payment systems to track card transactions and determine whether fraud is likely. Banks are now able to differentiate between certain characteristics existing in fraudulent and non-fraudulent transactions thanks to the extensive transaction history accessible for credit card portfolios.

2. Revenue and Credit Risk modelling

Due to the difficulty of interpreting ML models and the difficulty of simply verifying them for regulatory reasons, banks typically utilize classical credit risk models to predict category, continuous, or binary output variables. Nevertheless, they can still be applied to enhance the variables selection procedure and optimize the parameters in the current regulatory models.

Although they have non-linear features, AI-based decision tree approaches can produce easy-to-trace and logical decision rules. While support vector machines and other classification approaches can be used to forecast important credit risk features like LGD for loans, unsupervised approaches can be utilized to examine the data for conventional credit risk modelling.

Also, financial services companies are increasingly employing advisors that use deep learning techniques to build their revenue prediction models under pressure scenarios.

3. Loan approval process

Loaning money to individuals and businesses is a bank’s main business. The largest risk to a bank is the possibility that a borrower won’t be able to pay back the entire amount borrowed. This credit risk can be minimized with proper loan approval. Estimating the likelihood of default for a new loan application is crucial to deciding whether the loan should be granted by the bank or not.

Existing banks already have access to a vast history of loans as well as defaults. When combined with contract details, this can serve as a useful foundation for the machine learning model for loan approval. In this case, the aspects of the contract are the variables, and the label indicates whether or not the client/company defaulted.

For example, classification algorithms, which divide the data into two categories- “default” or “non-default” on the basis of their features, would be one form of applicable ML model. In this type of model, based on their likelihood of making a loan default in the future, classification algorithms can help to categorize a potential borrower’s application as either accepted or denied.

4. Monitoring behaviour and market abuse in trading

The monitoring of conduct violations by traders employed by financial firms is another area where machine learning is rapidly being used. Rogue trading, insider trading, etc., are a few examples of these transgressions, which can cost financial institutions a lot of money and damage their reputation. System automation has been created in the past few years to track the actions of traders in various ways and with growing precision.

The only way the initial generation of these monitoring systems could track trading behaviour was by analyzing individual trades. The enhanced versions of algorithms can now assess whole trading portfolios thanks to machine learning approaches’ greater capacity to spot significant, intricate patterns in data. These systems can also connect a trader’s trading activity to other behavioural data, like phone calls, building check-in and check-out dates, and even email traffic.

With technologies like Natural language processing (NLP), these sources are now machine-readable and appropriate for automated analysis. The outcomes of one or more traders’ trading conduct and communications are then combined and contrasted with a “normal” behaviour profile. The system will notify the financial institution’s compliance team whenever a trader’s actions or performance differs from what is considered usual.

5. Credit Assessment

A credit rating firm may assign a credit score to businesses or debt products. Several reputable rating agencies offer these credit scores, which represent their estimation of the likelihood that the debt instrument or company will default. FIs also utilize internal credit rating models in addition to these scoring agencies to establish a credit score. A firm, a debt instrument, or an individual’s creditworthiness can also be predicted using credit scores.

Supervised machine learning models are appropriate for credit rating/scoring since the machine learning model may be trained on past data. Observation of the label as either ‘default’ or ‘not default’ and substantial financial data or can be said ‘the features’ are typically accessible for historical data.

Unlike conventional credit scoring models, supervised machine learning models can be utilized to generate trustworthy credit scores in an open and transparent manner.

Conclusion

There have already been decades of machine learning (ML) models. But, the exploding availability of data and processing power has given ML models a tonne of new potential. Using them in risk management is one potential usage.

Models used in risk management can be improved upon or replaced by machine learning. It can be applied in numerous types of models and in multiple ways. In this article, a few use cases have been given, although there exist many more.