Machine Learning in Finance

As we move into a new level of customer experience, the requirement for quick, accurate financial evaluation, financial engineering, and forecasting has grown. It is impossible to overestimate the obvious advantages of using machine learning in banking, finance, and predictive analytics. Numerous successful cases have demonstrated the advantages in real-life cases.

Through the use of machine learning applications in the financial industry, businesses may automate tedious, time-consuming operations and provide customers with a much more refined and customized experience. Additionally, it allows the industry to work more effectively with enormous databases, greatly enhancing the accuracy of asset assessment, predicting financial performance, and resolving other crucial problems pertaining to data security for the financial sector.

Nowadays, machine learning in finance is regarded as a crucial component of a number of financial applications and services, such as asset management, risk assessment, credit scoring, and even loan approval. Machine learning, a branch of data science, enables computers to learn from experience and get better over time without having to be programmed.

In the financial sector, machine learning is a practice that is constantly expanding and being used in a variety of ways. Numerous new machine-learning finance jobs have also become available as a result of machine learning’s many uses in finance. Let’s see how it is useful to comprehend machine learning in finance and how it might be applied to advance the industry.

Financial Oversight

The application of machine learning techniques can greatly improve network security. Financial monitoring can help identify flags like money laundering strategies, which data scientists are always developing training systems to spot. Machine learning technology could very well power the most cutting-edge cybersecurity networks in the future.

Risk Control

Banks and other financial institutions can considerably reduce risk levels by using machine learning methods to analyze a vast array of data sources. Machine learning can analyze large volumes of personal information to reduce risk, in contrast to traditional techniques which are typically confined to critical information like credit scores.

Machine learning also offers banking and financial services companies with useful intelligence that can be used to inform future decisions. Machine learning curriculums that assign risk scores to loan applicants based on data from various sources could serve as an illustration of this. Then, using Machine learning algorithms, firms may quickly identify the clients who are likely to default on their loans and reevaluate or modify terms for each client.

Management of Customer Data

Data is the primary resource for banks and other financial institutions, so effective data management is essential to the expansion and success of the industry.

Even for financial experts, manually processing the enormous volume and diverse structure of financial data—from mobile communication services, and activity on social media to details of transactions and market data—presents a significant barrier.

Utilizing machine learning methods to handle such massive amounts of data can improve process effectiveness and provide the advantage of deriving true knowledge from the data. Data mining, data analytics and natural language processing (NLP) are examples of AI and machine learning techniques that assist in gaining insightful information from data for increased corporate profitability.

Machine learning techniques that analyze the impact of market changes and particular financial patterns from the financial records of consumers are a great illustration of this.

Program for retaining customers

ML technology can be used by credit card firms to identify at-risk consumers and keep a certain subset of them. They can predict user behaviour and create offers exclusively for these customers based on consumers’ demographic information and transaction activities.

Here, a recommender model is used to identify the best card offers that can assist in retaining these customers after using a predictive model (binary classification model) to identify the customers at risk.

Finance Marketing

Machine learning models are excellent marketing tools because they can make precise forecasts based on prior behaviour. Machine learning algorithms can assist in developing a strong marketing plan for finance companies by examining web activity, mobile app usage, and responses to prior advertising campaigns.

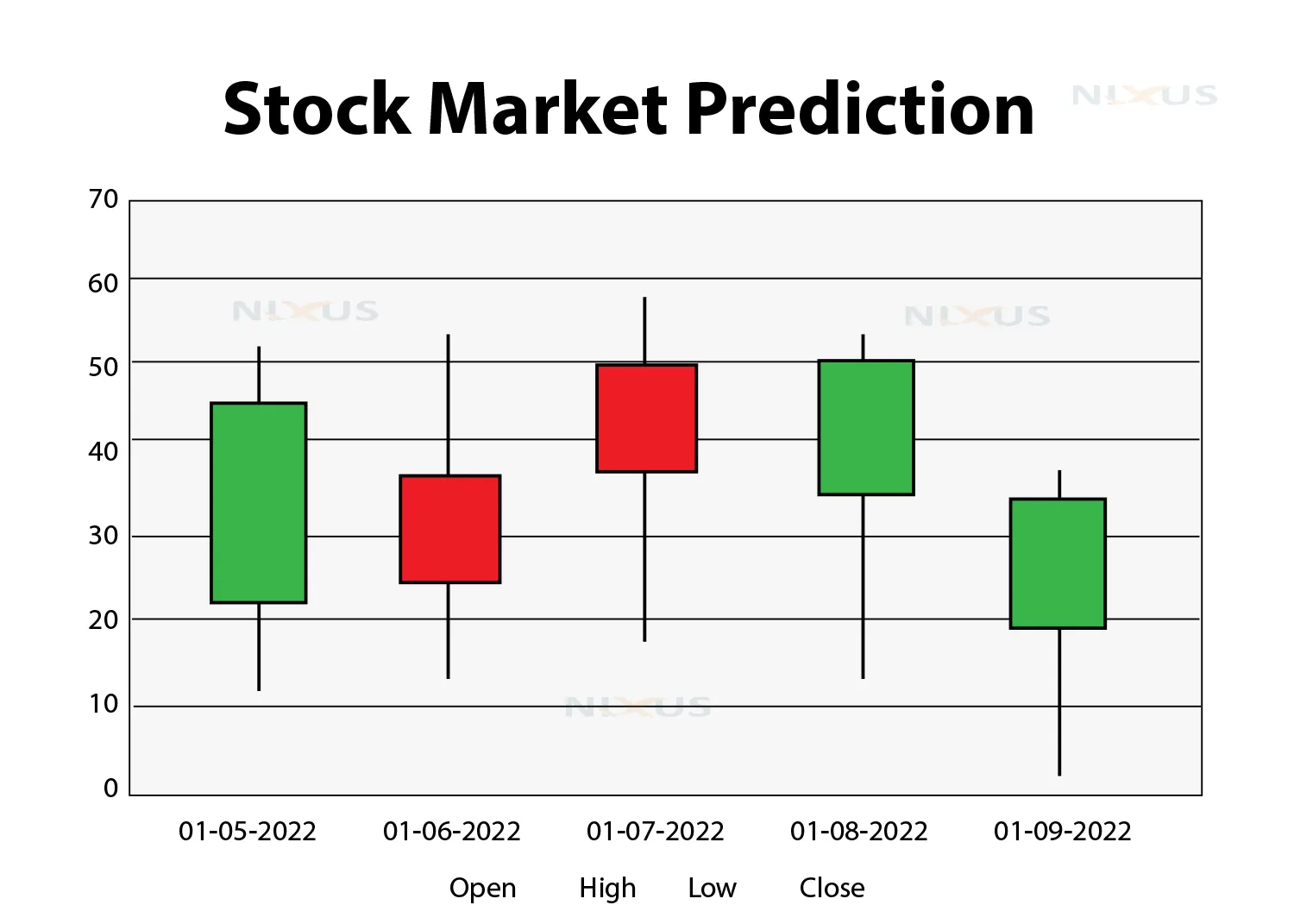

Prediction of the stock market

In the trading industry, projections of stock market swings are sometimes undervalued and even dismissed as pseudoscientific. Some traditional traders still hold this belief and daily study a large number of stock charts using Japanese candlesticks.

However with ML, depending on the knowledge they have of the past and present for every stock, corporations may now make educated predictions and educated estimates. Stock technical analysis is a method of forecasting a stock’s price direction based on historical stock price movements and patterns.

Prediction of customer churn

Any significant mobile operator or telecommunications provider can serve as an illustration of how machine learning is used in real-world scenarios to forecast client churn. Almost all businesses that sell subscriptions fall under this category.

Detecting and preventing fraud

Each year, fraud causes billions of dollars worth of losses for businesses that provide banking services and financial services, making it a serious concern. There is a higher danger of a security breach because finance organizations typically store a lot of their data online. Fraud in the financial sector is increasingly seen as a serious threat to important data due to the rapid evolution of technology.

In the past, fraud detection solutions were created using a set of rules, but modern fraudsters may easily get around those standards. Thus, the majority of businesses nowadays use machine learning to identify and block illegal financial activities. When a security team identifies unusual activity or an anomaly, machine learning flags it for further investigation. It does this by scanning through massive data sets to identify these patterns.

It determines whether a flagged transaction is similar to the account holder’s behaviour by comparing it to other data points, such as the customer’s profile history, location, IP address, etc. The system may then automatically reject a purchase or withdrawal until a person decides, depending on the specifics of the transaction.

Reduction of Human Error

There will always be human error. However, even a tiny mistake in the financial industry can have a big impact and cost millions of dollars. Human errors can be significantly reduced, and accurate data processing can be ensured by substituting or enhancing machine learning techniques.

Both Timely and Economical

Machine learning requires less time and provides immediate results. Making difficult decisions and precise forecasts can be facilitated, and the manual task can be sped up.

The advancement of machine learning and AI is ongoing. In the long term, it may prove to be a worthwhile investment despite the initial outlay and ongoing expenses.

Automated Process

One of the most prevalent but useful applications of machine learning in the finance sector is probably process automation. Automation can help businesses replace manual labour, enhance services, and boost productivity. Examples include chatbots, call centre automation, gamification of staff training, and document automation.

Companies using Machine learning

There are so many companies that are currently using machine learning in finance. Some of the examples are as follows:

1. DATAVISOR

In order to facilitate fraud detection, Datavisor employs unsupervised machine learning. Machines may find new sorts of fraudulent behaviour with machine learning without having to be retrained. The technology used by Datavisor combines graph analysis with clustering methods to find trends in data (unlabeled) among billions of profiles.

2. FEEDZAI

In order to deliver ML services for mitigating risk both online and offline, Feedzai collaborates with international finance organizations, retailers and banks. Feedzai analyzes and finds unusual patterns in transactions and event data for hazards like money laundering and fraud.

3. RISKIFIED

For e-commerce businesses, Riskified is indeed a fraud solution. The machine learning tool helps businesses identify faulty orders and avoid chargebacks. The fraud detection system guarantees fewer false positives for fraudulent activity and continually picks up new fraud techniques, keeping businesses ahead of fraudulent orders and assisting them in retaining more clients.

4. KABBAGE

Kabbage offers credit lines to small businesses for 150,000 and more clients. Its straightforward company application procedure (available online or via a mobile app) employs machine learning techniques to decide whether an applicant is authorized or not, lowering the likelihood of human error.

Conclusion

Because of the available computing power and emerging machine learning technologies, finance is the industry with the highest prevalence of ML. The simplification of finance marketing and assistance with precise sales forecasting is among the biggest advantages of machine learning in finance.

Many jobs that are beyond the capabilities of humans can be handled by machine learning algorithms, which also eliminate human mistakes. The algorithms act as a bridge to an entirely faultless automated finance system since they are continually learning.